Bitcoin Complete Price Analysis: At what price should I buy Bitcoin?

TL:DR (Spoiler alert) Continue to somewhere between $31.600 and $44.200 or start at $18.400 a downward correction with a scary lower bound.

On 2018 the Oracle of Omaha, Warren Buffet, said this about crypto-currencies: "They will come to a bad ending".

And at least from January 2018 up to November 2020 he was right. Just recently, almost three years later, people who bought at $ 15.000-20.000 can start selling without realizing a loss.

But the question now is, what next?

Forbes says the breakeven price for Bitcoin miners is $ 8.000, this and the halving/halvening are really interesting for a supply side analysis but if nobody is willing to pay those prices it won't matter much.

The words of Aswath Damodaran that follow in the video above are key when trying to valuate Bitcoin. Unlike Ethereum that is a crypto-commodity, the fuel for smart contracts, Bitcoin is a crypto-currency, so it cannot be valuated because it's a currency.

Much like the US dollar or the Euro, Bitcoin is a matter of history and trust. Or unlike the Argentine Peso, maybe the good thing is that there's still no person or institution in sight to distrust.

So, as Bitcoin is being priced and not valuated we can only use human psychology to try to predict its value, aka Technical Analysis. The non-validated theory of trying to make a model of investors sentiment by only looking at a price-time graph to predict future prices.

First things first as it's all a matter of proportions, for a long term graph analysis use semi-logarithmic scale (I always use it). If not, a price movement from 1 to 10 looks exactly the same as one from 15.001 to 15.010 when the former is a 900% movement and the latter just 0,06%.

Lineal:

For technical analysis I prefer NeoWave theory, more specifically Glenn Neely's book Mastering Elliott Wave. After years of observations he explains how every price movement is either part of a correction called ABC or an impulse called 12345 and how both combine to construct bigger formations. And it works because on every graph I'll always be able to find one of this patterns, like a conspiracy theory.

Remember, people will buy or sell when they think so and not when the graph thinks so. In other words, the final pattern will only be revealed when it ends and before that we can only build two or more scenarios.

I'll try to summarize and be as quick as possible while giving enough information to let anyone knowing the theory repeat the process. I'll follow the theory and make some assumptions when there is no "correct" path available (Also remember: "Assumption is the mother of all f@ck ups!").

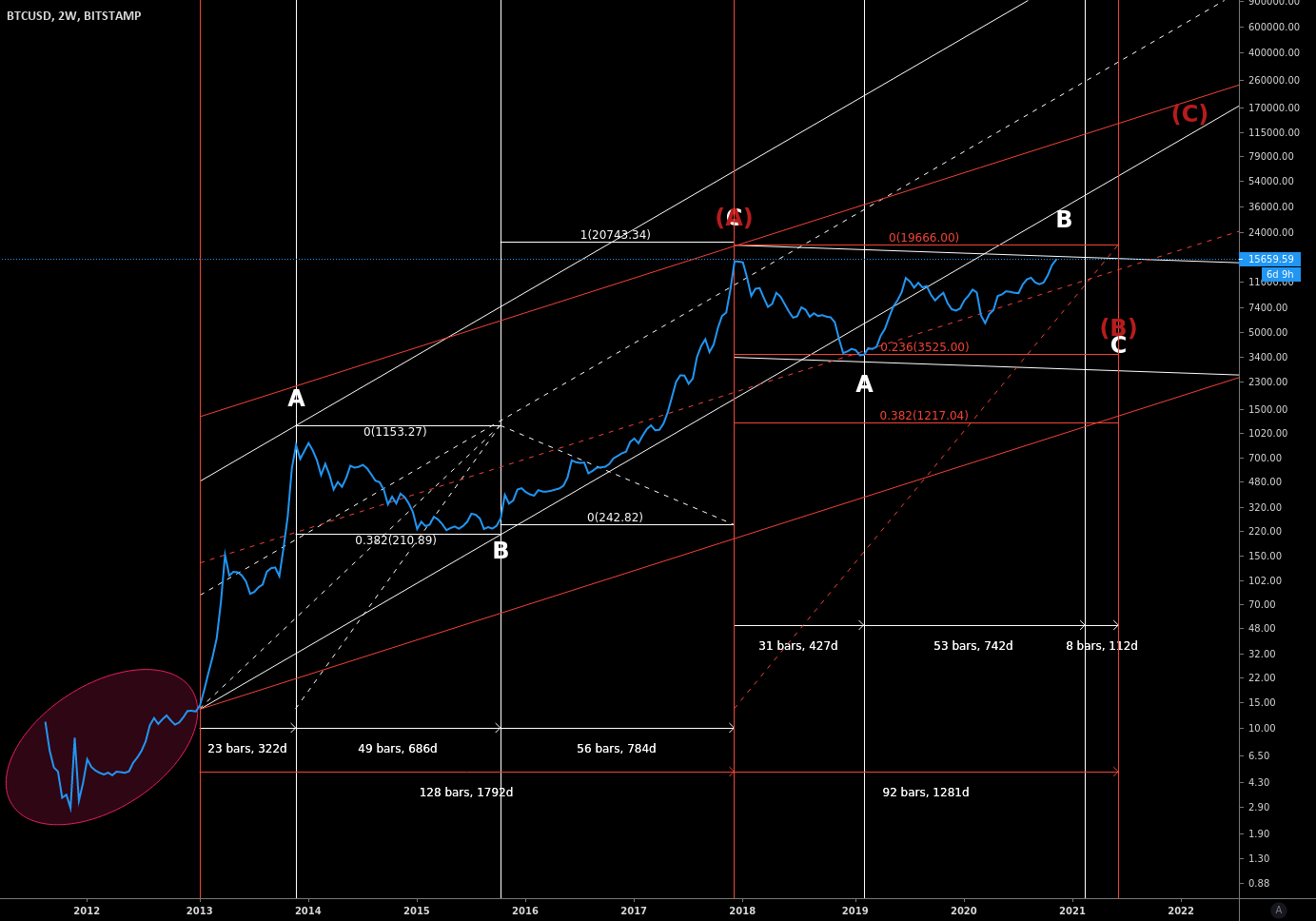

I arrived to the pattern shown above because I couldn't fit all the construction and confirmation rules from the red circle to A to form an impulse. So the red circle is just noise, the inception of bitcoin when there was very low volume and not many exchanges unlike we have now. Result: We have (in white) a complete and confirmed ABC correction pattern from the start of 2013 to the end of 2017.

So with the premise above, Bitcoin price is in the middle of a huge correction and that brings us two possibilities:

A) B already finished at $ 3.350 on February 2019

B) B is not finished

In the first option I can't build a proper channel because of the white A going above the red channel, looks out of context. Also now we are still on a lateralization phase, more like a correction not an impulse, and Neely based on its observations says that when in doubt you may still be in the middle of a B wave. Result: We are on a B wave that started on the end of 2017 and is still in progress.

This is what we have up to now:

Let's zoom in to analyse the red B in more detail:

The price inside the green segment is battling between the upper part of the green channel and the next two Fibonacci level (in proper terms a Common Flat or an Elongated Flat as shown in the figures below). As it is not supposed to touch perfectly the channel four times (candle graphs below), we should expect Bitcoin price to:

1) Go to $ ~18,000.00

- Common Flat

- Green C at the 1.000% Fibonacci level of A

2) Go between $ ~31,000 $ ~44,000

- Elongated Flat

- Green C at the 1.618% Fibonacci level of A

- Maybe at 1.382% but it like to keep it simple

1) $ ~18,000

2) Between $ ~31,000 and $ ~44,000

MY COMPLETE FINAL TWO SCENARIOS:First Up)

First Down)

Buying right now, at $ 16,500 could be a good trade because $ 18,000 looks extremely likely following NeoWave rules.

But the movement to $ 18.000 may come with a previous visit to $ 14.000 and trading is not the same as investing. So if you are an investor, using 18 month timeframes and minimizing risks, the best move seems to be waiting to see what happens at $ 18,000.

After all this correction, if you believe in a Bitcoin centric future or something similar, I assume you are expecting at least $ 100,000. So you won't miss your opportunity to buy by waiting a couple more days.

If it goes down after touching $ 18,000, the Fibonacci levels are:

- 0.382 = $ 9,347.45

- 0.618 = $ 6,155.83

- 1.000 = $ 3,130.79

- 1.618 = $ 1,048.61

That $ 1,048.61 (horizontal white line on option "First Down" or better on the graph below) looks really scary. But seems impossible with all the hype around Bitcoin.

If it goes down after touching $ 44.000, the Fibonacci levels are:

- 0.382 = $ 22,501.53

- 0.618 = $ 14,818.54

- 1.000 = $ 7,536.56

- 1.618 = $ 2,524.26

Its convenient to assign more weight the 0.618 levels. See how the above 0.618 price is just what is needed to confirm the green channel (breaking the 0-B line).

Now do your math and choose what you prefer!

Link to my TradingView idea: Bitcoin Price Analysis: At what price should I buy Bitcoin?

P.S. If Warren finally invest in Paypal, it would be indirectly investing in Bitcoin!

P.S. Same image using candles for those who prefer:

Comments

Post a Comment